Day exchanging, for individuals who can do it admirably, is a remarkable method to get cash. What used to be a specific field, overwhelmed by sellers watching the shows on the floor at Wall Street is, like never before, an undertaking done by individuals at home, utilizing the web and mechanized exercises to get day exchanging calling achievement. Getting to that guaranteed where there is day exchanging work achievement is something that takes coaching and an ability to defy troubles; anyway it’s practical for anybody to get it done assuming they will contribute the time. You should not to be a virtuoso to do this, you should be aware.

Most days exchanging calling achievement comes from managing your responsibilities making a huge load of exchanges that appeared, apparently, to be a keen idea by then, with the data you had open This is generally called ‘getting cash as our forebears would Eminifx Review made it happen – by losing it and gaining from it’. How rapidly you get to accomplishment in stock exchanging stems overall from how rapidly you can learn. There is no clandestine recipe to this present; it’s associated with learning the bewildering nuances a few market locales and figuring out an acceptable method for examining the signs. Anybody selling you a course is attempting to commit reference to you what awkward errors they procured from so you don’t need to make them yourself.

Comprehend that day exchanging work achievement – and reaching the place where you constantly get cash – will be a collaboration of submitting botches. An of those errors will be absurd; you will think you have the market investigated reasonably, you will put EminiFX, and you will see that there is either a fumbled probability, or you got a handle on something too lengthy and lost cash overall. Since day exchanging is about market whimsies and utilizing that to make your exchanges and make your benefits, there will dependably be one more exchange to be made. Acquire from your staggers, yet don’t annoy them.

Comprehend that day exchanging work achievement – and reaching the place where you constantly get cash – will be a collaboration of submitting botches. An of those errors will be absurd; you will think you have the market investigated reasonably, you will put EminiFX, and you will see that there is either a fumbled probability, or you got a handle on something too lengthy and lost cash overall. Since day exchanging is about market whimsies and utilizing that to make your exchanges and make your benefits, there will dependably be one more exchange to be made. Acquire from your staggers, yet don’t annoy them.

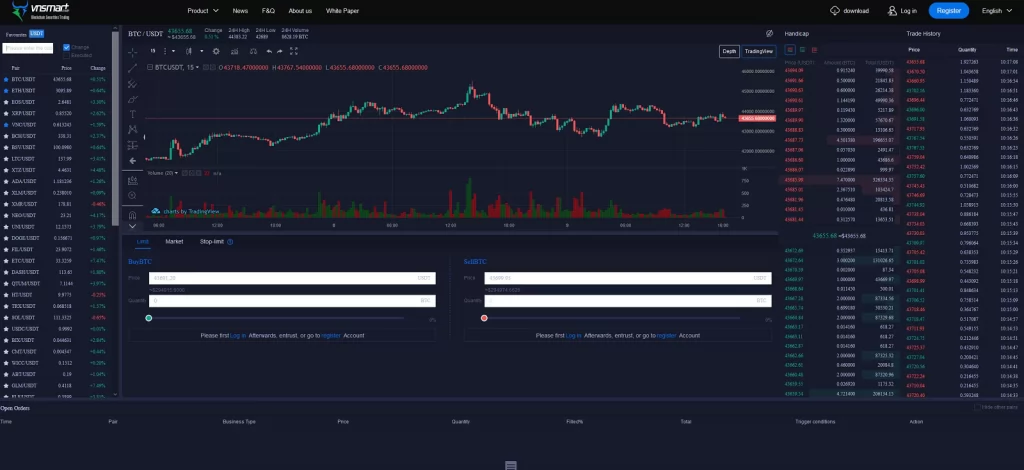

A decent method to learn day exchanging is with a test account; in a perfect world with a preparation program of some kind You will be in a circumstance where somebody who’s seeing near market information you are makes sense of what signals they saw, and makes sense of how they made their exchanges, and why. The mechanics of day exchanging are fundamental, and in a tremendous heap of cases, altogether robotized. The certified procedure comes from inspecting the tea leaves of opening and shutting costs on stocks or characteristics in the space you are pondering.

Tremendous amounts of these characteristics will follow express models that can be followed, and predicted…most of the time. Knowing when the market has ‘left the normal stage’ is likewise a basic activity to learn. Especially like playing poker, once in a while the triumphant play is to overlay early when you could manage without the energies of the signs you are getting. Day exchanging calling achievement comes from mentoring, it doesn’t appear for a circumstance, and it doesn’t come from a computerized program. Really try not to recognize any day exchanging program that analyzes how you can get cash with no issue. Day exchanging is a task; a task requires a specific exactingness, a specific level of monomania, and a specific arrangement to face troubles.

Basically audit, mechanized gadgets like stock exchanging programming don’t have judgment – they can execute exchanges as indicated by restricts you entered near the beginning, yet assuming they experience something outside their cutoff points, they are relatively disposed to lose you cash as make you cash. All the mechanized programming contraptions do is save your opportunity to do assessment, and handle the long subtleties that you’d notwithstanding deal with on the telephone with a transporter.